gift in kind receipt

Therefore the advantage must be 50 or less. A donor gives a charity a house valued at 100000.

Treasurers Training Day Ppt Download

Yes indeed in effect.

. Whether you have receipts to the penny or if you know from other valid references regarding the expense paid for by the corporation. They are receipted separately using the. This class is recommended for anyone living with or caring for infants and young children.

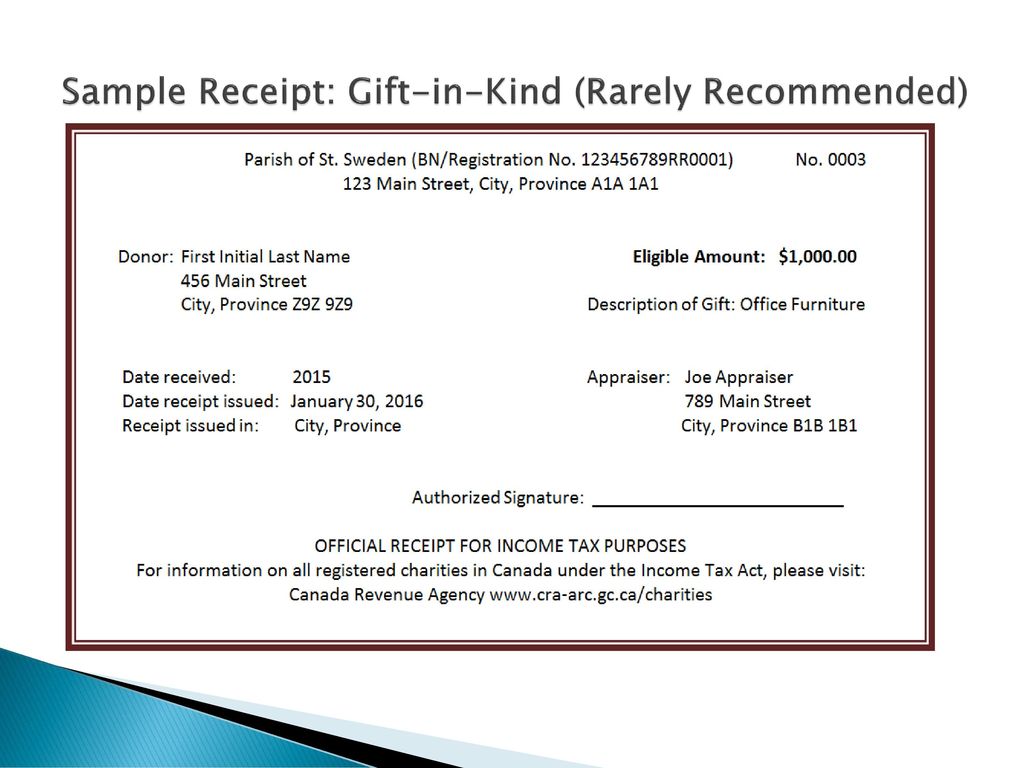

Fall 2012 Date of most recent revision if applicable. K-4 Responsible for Policy. Donors who give gifts in kind would like to know the benefits of a receipt for a gift in kind.

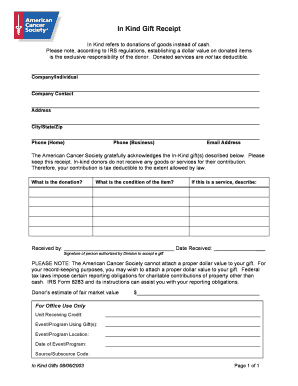

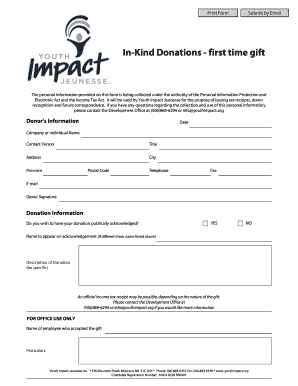

Lincoln NE 68510. Contributions of nonfinancial assets or so-called gifts-in-kind GIK can be an important source of financial support for nonprofits. In Kind Gift Receipt In Kind refers to donations of goods instead of cash.

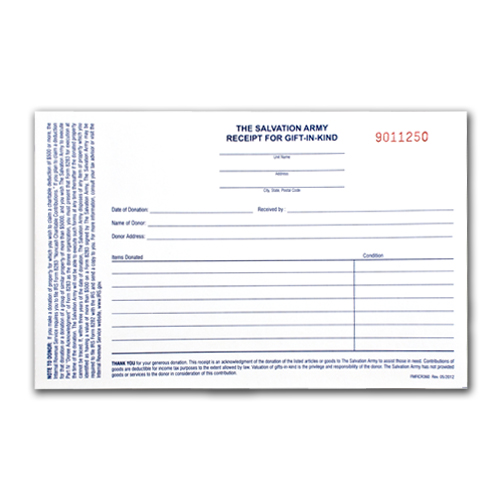

Sample 4 Non-cash gift with advantage. 9112022 900 AM. In-kind donation receipts should include the donors name the description of the gift and the date the gift was received.

Lincoln NE 68508 P. Some examples of in. 4024751303 HOMELESS PREVENTION CENTER.

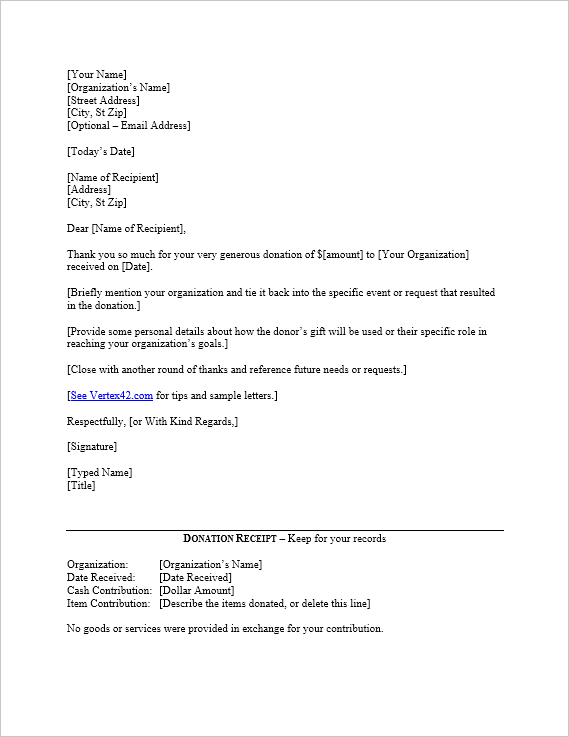

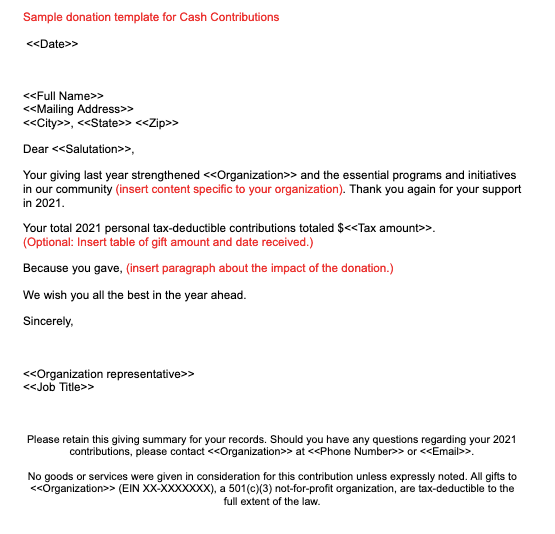

Please note according to IRS regulations establishing a dollar value on donated items is the exclusive responsibility. In-kind donations are non-cash gifts made to nonprofit organizations. A cash donation receipt provides written documentation of a cash gift.

In-Kind Gift Receipt Policy Number. The amount of the advantage 20000 must be. 10 of 500 is 50.

A dollar is a. It is an acknowledgement provided to the donor only upon receipt of the gift. For cash checks and other monetary donations the process is more straightforwardThis is because your cash gifts already have an explicit value.

Your gifts allow us to provide needed resources and support for other Christian. It also helps donors in they need to claim a tax deduction for gifts. While determining the fair value of cash.

The following calculations are used to determine the eligible amount of the gift for receipting purposes. Yes you are the recipient of a very generous In-Kind gift. In the case of a donor having an amount taken directly from their paycheck they can use a W-2 wage and tax statement or other employer-provided documents that detail the.

May 2010 Most recent review. In-kind donations for nonprofits can be made by individuals corporations and businesses. The donations must be entered with exactly Gift in Kind in the Cheque Paid By field and must have a description of the gift in the Description field.

Infant and Child CPR Safety. Do they receive the same deduction as for a receipt for a cash donation. In-kind donation receipts.

The charity gives the donor 20000 in return.

Donation Receipt Template Download Printable Pdf Templateroller

In Kind Gift Receipt Form Fill Out And Sign Printable Pdf Template Signnow

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

40 Donation Receipt Templates Letters Goodwill Non Profit

Free Donation Thank You Letter Template

Acknowledge And Issues A Cra Donation Receipt For An In Kind Gift By Cloudstack Services Issuu

Explore Our Sample Of Gift In Kind Donation Receipt Template Receipt Template Letter Templates Templates

Explore Our Example Of Non Profit Contribution Receipt Template Receipt Template Non Profit Donations Donation Letter Template

Why How And When To Issue Charitable Donation Receipts

Free Donation Receipt Templates Silent Partner Software

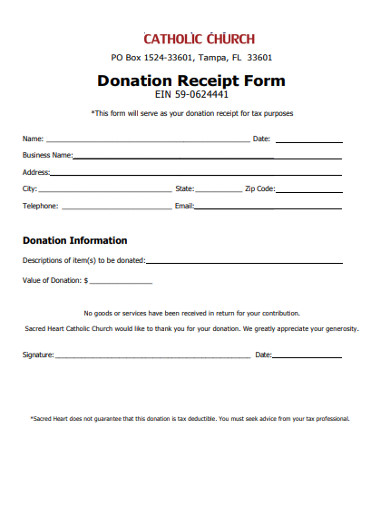

Church Donation Form 15 Examples Format Pdf Examples

In Kind Donation Receipt Template Printable Pdf Word

23 Printable Donation Receipt For Tax Purposes Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

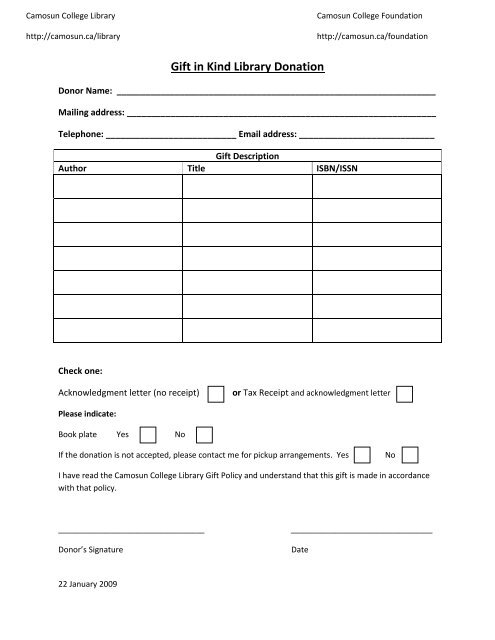

Gift In Kind Library Donation Camosun College

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

129 Printable Donation Receipt Template Forms Fillable Samples In Pdf Word To Download Pdffiller

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox